Shweta Tambade

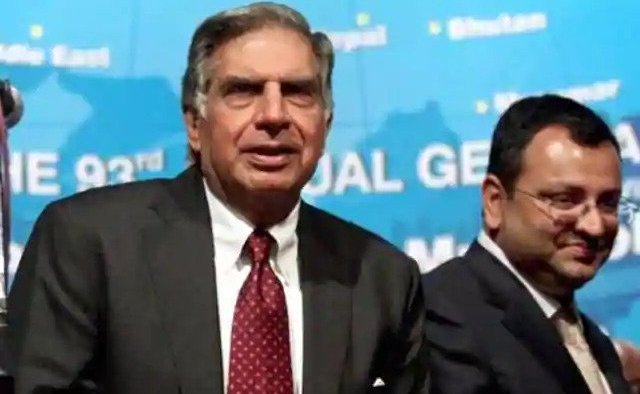

The Supreme Court heard the infamous case of Tata-Mistry case, regarding the reinstatement of Cyrus Mistry as chairperson of Tata Sons Pvt Ltd.

Previously the Supreme Court had restricted Shapoorji Pallonji Group from selling the shares of Tata sons owned by the group.

Tata Sons have challenged the NCLAT (National Company Law Appellate Tribunal) order dated December 18, 2019, that had asked for the reinstatement of Cyrus Mistry as the Chairperson of Tata Sons Limited.

The Shapoorji Pallonji Group had planned to raise Rs 11,000 crore from different funds and had signed a deal with a marquee Canadian investor for Rs 3,750 crore in the first tranche against a portion of its 18.37 percent stake in Tata Sons.

Tata Sons had previously noticed the Supreme Court in an affidavit while answering to the cross-appeal filed by Cyrus Investments, that it was not a ‘two-group company.’

SC stayed the National Company Law Appellate Tribunal (NCLAT) order in January, which restored Mistry as the executive chairman of the conglomerate, and granted relief to Tata Sons.

The top court had also observed there were ‘lacunas’ in the orders passed by the tribunal.

Replying to Tata’s petition that was challenging his reinstatement order by the NCLAT, Mistry had also claimed that Ratan Tata should reimburse all the expenses to Tata Sons since his resignation in December 2012 in keeping with the best global governance standards.

In its affidavit filed in the top court, Tata Sons alleged that Cyrus Investments’ focus has turned to propagate the quasi-partnership theory for securing the relief of ‘proportionate representation.’

Hearing the case on 8th December 2020, the representative of Tata Sons group, Senior Counsel Harish Salve told the top court, “NCLAT can’t take it upon itself to overrule shareholders, make appointments by itself. Being private co, Trustees of Tata Trusts with a 68% shareholding in Tata Sons would be within their rights to pack the board with their nominees.”

Harish Salve also said that the Companies Act, 2013 has permitted the Tata group to be converted from public to private company.

The trustees of Tata Trusts were always in check of Tata Sons, which one by one held a stake in a slew of listed companies. Pallonji joined Tata Sons’ shareholding in 1965, enjoying about an 18% stake.

Salve further threw light on the fact that Cyrus Mistry was due to retire in March 2017. If he had quit office in March 2017, there are no provisions that would have helped him to make a case for reappointment.

The top court questioned the suo motu powers of the NCLAT, “Can the NCLAT select and appoint an Executive Chairperson?”

Pallonji Group maintains a value of over Rs 1.75 lakh crore out of its 18% shareholding in Tata Sons.

Nonetheless, Tata Sons’ counsel told the Supreme Court that according to their calculations, the Pallonji Groups’ shareholding in Tata Sons is worth not more than Rs 70,000 crore to Rs 80,000 crore.

After hearing Senior Counsel Harish Salve, the Supreme court has postponed the hearing to December 9.