Ambika Bhardwaj

Published On: December 20, 2021 at 17:10 IST

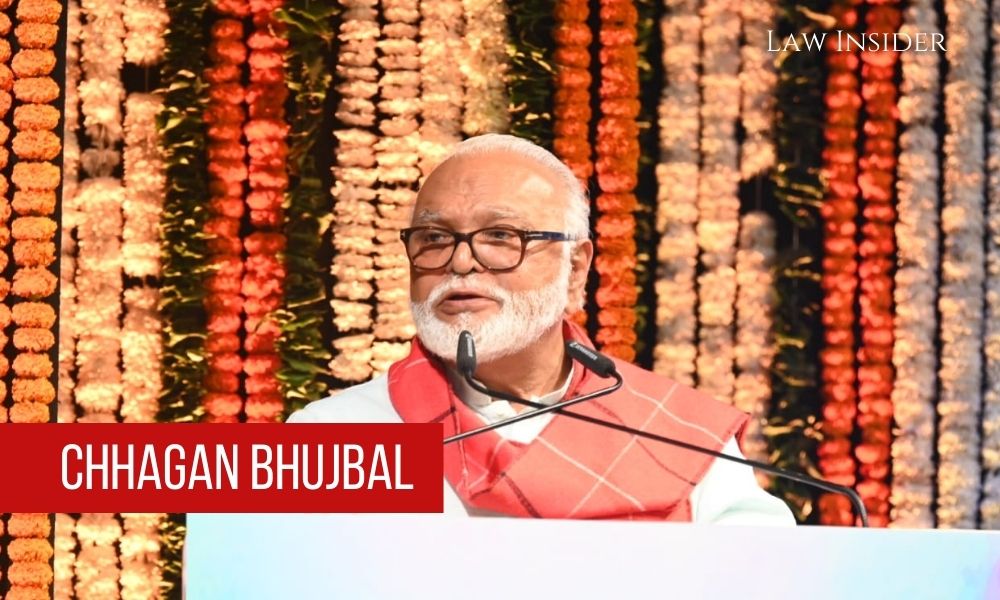

The Bombay High Court dismissed a Petition filed by Maharashtra Cabinet Minister Chhagan Bhujbal Challenging an Income Tax Department show cause notification.

A Division Bench of Justices K R Shriram and A B Borkar noticed earlier this month that they saw no cause to assert their extraordinary Jurisdiction under Article 226 of the Indian Constitution and Restrict the Authority from moving ahead further in the issue.

Bhujbal’s Petition was filed in response to a notification issued by the Assessing Officer on March 31, 2019 under Section 148 of the Income Tax Act, 1961 ( (the Act). According to the notice, there are “reasons to believe that Income Chargeable to Tax for the Fiscal Year 2012-13 has managed to escape assessment within the meaning of Section 147 of the Act.”

According to the March 2019 notice, the Assessing Officer had reason to suspect that Income Chargeable to Tax for the Fiscal Year 2012-13 had managed to escape assessment under Section 147 of the Act. Bhujbal then requested additional information from the department, which he received in September 2019.Following that, another notice was issued in December 2019 that indicated the amount.

The IT department responded to the submissions by claiming that Bhujbal seemed to have no problems receiving the first notice, the causes for re-opening, or when the Objections filed were denied by an Order in October, 2019. It was also contended that although the objections have been upheld, Bhujbal took part in the assessment proceedings, making submissions and filing documents in accordance with the notice in November.

The Court noted that the test to be implemented in the Case was whether there is any reason to think that income had managed to escape assessment and whether the Assessing Officer had tangible content before him for forming the belief. The Court decided that in this Case, the reasons do indeed reveal what that tangible substance is, and that “once a tangible basis for re-opening the assessment had been revealed, it would not be suitable for the Court to avoid any Inquiry whatsoever by the Assessing Officer.”