By Nisman Parpia

In every society, relationships are built on commercial and non-commercial agreements. Parties comply with a negotiated and typically binding arrangement of things between them, on the course of action which can be due one other.

These arrangements can be off and for a variety of reasons, and it is important that the arrangement should not be done away with, where its value fades prematurely.

It is essential for any arrangement to have an element of bindingness with the help of legal sanctions for it to thrive in a democratic state, for this purpose, the arrangements within an agreement between the parties are written or typed on a piece of paper bearing a particular value in the eyes of law which is exclusively sanctioned by the state for the purpose of adding lawful adherence to an agreement, these papers bearing evidentiary values are known as stamp papers.

The Indian Stamp Act, 1899 defines stamp as:

Stamp means any mark, seal or endorsement by any agency or person which is duly authorized by the State Government, and includes an adhesive, serving the needs purposes of duty that is chargeable under this Act. There are 14 different types of stamp papers that are available in 10 denominations.

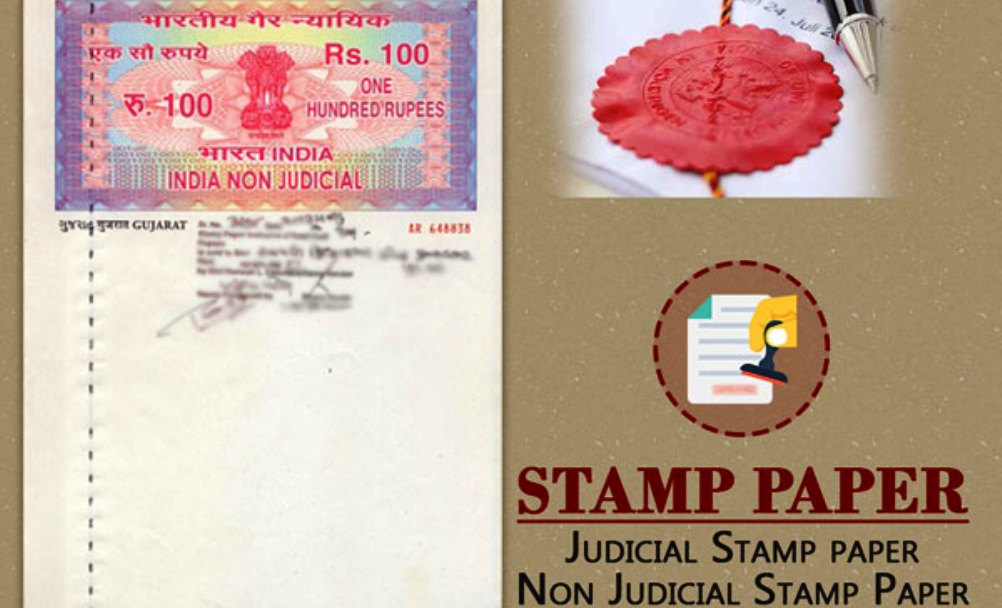

What is stamp paper?

The stamp paper is a foolscap size paper having printed revenue of a selected value like Rs.10, Rs.20, Rs. 50, Rs.100, Rs.500 etc. by the government. All-important transactions like buying, selling, or renting of any property shall be done on stamp paper.

The stamp paper is additionally used for giving power of attorney or doing any sort of agreement containing financial deals, contracts, affidavits, declarations. It is always advisable to purchase stamp papers from Government approved legal stamp vendors.

Though every stamp paper carries a monetary value it can neither be treated as a negotiable instrument or legal document nor exchanged like currency notes. The document is used for providing authenticity to official agreements.

Documents with legal implications like Lease Agreement, Buying and Selling of Property, Business Contract Agreements, Loan Agreements, Financial Deals, Power of Attorney, Affidavits, Articles of Association, Memorandum of Association, Indemnity Bond, Declaration, Mortgage, and Gift Deed among others are executed on stamp papers to form them as legitimate and legally enforceable documents.

Judicial and non-judicial stamp papers have been in use in many countries. However, lately, electronic versions (E-Stamp paper) are being developed so as to extend the ease of doing business and also to scale back the threat of fraud.

Stamp duty and its significance

For every type of transaction, a certain amount of stamp duty has been determined by the state. Different states levy different stamp duty for a different transaction. Hence the Government fixes the Stamp Duty for each article and collects the revenue from the stamp duty.

Stamp Duty is that tax which is levied on the legal acknowledgment and adherence of documents. According to the law, it is mandatory to pay stamp duty to the Central/State Government when certain transactions are made. The value of stamp duty is either fixed or it is bound to change with the worth of property/instrument under question.

The Indian Stamp Act, 1899 deals with stamping of agreements/documents in India. Stamping of agreements and documents is desirable because it ensures legality and validity, enforceability, and admissibility in court since such agreements as they can then be registered under the Indian Registration Act, 1908, which in turn certifies its enforceability.

The Indian Registration Act provides for registration of documents thereby recording the contents of the document. Registration is mandatory to conserve evidence and title. There are certain agreements mentioned under section 17 of the Indian Registration Act, which are to be compulsorily registered and therefore, cannot be made without stamp paper. Some of these are:

- Instruments pertaining to immovable property, that is, sale deed, agreement to sell, gift deed, lease, and others.

- Instruments concerning movable property valued at or above INR 100.

- Lease deed of an immovable property, where the lease exceeds a year.

- Instruments that transfer or assign a decree or order of Court for a value exceeding INR 100 and immovable property.

- Document to adopt a son executed aside from the procedure through will.

Necessity of stamp papers

Whether an individual is documenting a daily business transaction or executing an agreement for an upcoming project, a stamp paper is a necessity for adding a legal sanction to the document.

There are 14 different varieties of stamp papers, available in 10 denominations. They are of two kinds: Judicial, used for legal and court work; non-judicial, assigned for registration of documents, insurance policies, to name a few.

The stamp papers are a crucial source of income for several developing countries. In some countries, it is difficult to gather direct taxes. That is where stamp duty may be a good source of revenue. Bangladesh is one such country which collects a large sum of tax revenue through stamp duty.

Stamp papers have also been widely used to collect taxes on various documents. The papers are always bought blank from licensed stamp vendors, post offices, Government Treasury offices, and courts. The concerned person then writes their mutual terms of the contract on the paper and lodges it with the court or concerned authority for legal validation.

This is an efficient, smooth and legal way of collecting taxes people owe to the government. It is also a passive way to get stamping documents legalized and authenticated without the requirement of submitting them to a responsible and authorized government authority.

Basic differences between judicial and non-judicial stamp paper

Judicial stamp paper is used mainly for payment of court fees and judicial activities. Stamp duty which is paid for judicial stamp paper is in accordance with the court fees act, 1870 while nonjudicial stamp paper is used mainly for execution of legal documents, is used in documents and transactions like agreements, real Estates, power of attorney and much more and is paid in accordance with the Indian stamp act 1899.

Non judicial stamp papers and its value

Non-Judicial Stamp Papers are used in matters which concern transactional arrangements between parties that are non-judicial in nature, such as an agreement to sell, affidavits, sale deed, lease agreement, amendment in the article of association, rent agreements, transfer of immovable property like building, land, mortgage or other important agreements.

Details required While Buying a Non-Judicial Stamp Paper are: First Party Name, Second Party Name, Addresses of both the parties, Document Name and Stamp Paper Value. The stamp duty of a transaction varies with the type of the transaction which has been fixed by the state. Different states levy different stamp duty for a different transaction and hence, Government allots the Stamp Duty for each article collecting revenue from the stamp duty.

For Example, Stamp Duty for:

- Affidavits is Rs 50/-

- Rupees 100 for General Power of Attorney

- 5% of amount secured, min 200 for Indemnity Bond/ Guarantee Bond

- 02% of market value for lease deeds below 1 year.

The stamps are used as per the rates which are determined by the government for recovery of the stamp duty. At present, one can use a non-judicial stamp paper of value Rs.5, Rs.10, Rs.20, Rs.50, Rs.100, Rs.500, Rs.1000, Rs.5000, Rs.10000, Rs.15000, Rs.20000, or Rs.25000 for the documents mentioned above.

The difference between 10, 20 and Rs. 50 non-judicial stamp papers:

The government collects the revenue through the sale of non-judicial stamp paper and for each article there is a separate stamp duty like: Stamp paper of Rs.10 is used for declaration, undertaking, affidavit et cetera. Stamp paper for Rs.20 is used for special power of attorney.

Stamp paper of Rs.50 is used for general power of attorney/agreement and stamp paper of rupees hundred is used for indemnity bond and guarantee bond. We have already learnt that stamp duty of nonjudicial stamp paper for every state differs. This mentioned stamp duty is allotted for Delhi.

Conclusion

Non Judicial stamp documents carry probative and evidentiary value but are largely dependent on the nature of transactions and the thing or place for which transaction is made whether it is movable or immovable for example a sale deed although made and stamped on a nonjudicial stamp paper also has to be notarized and registered with the local registrar’s office as per law, simple provision exist for lease deed also. in order to encourage the use of digital stamping of non-judicial physical stamp papers, the government of Gujarat has banned the use of physical stamp paper effective 1 October 2019 by our honorable Prime Minister, Shri Narendra Modi to promote the idea of Digital India and save paper, it will also reduce the risk of people being cheated by stamp vendors.

The facilities are available at all schedule banks and financial institutions under the control of state and central governments, licensee stamp windows, chartered accountants, post offices, C & F agents of ports, company secretaries, common service sectors under e-governance plan, license notaries among others and non banking financial companies registered under RBI. , it is mandatory to use stamp paper while legalizing an agreement or making a declaration.

By using a stamp paper, the document avail legal validity and can be enforced under the laws of the land. Depending upon the type of the document, an individual has to choose between judicial and non-judicial stamp paper and there are options of buying traditional stamp paper or opting for the E-stamping or franking process. Indeed stamp papers are an important part of the judicial and nonjudicial function of the society.

References

- Whether all Agreements should be on Stamp Paper and Registered

- Agreement On Non-Judicial Stamp Paper

- What is Stamp Paper? Know the Difference of Judicial & Non-Judicial Stamp Paper?

- Judicial and Non-Judicial Stamp Paper

- Stamp duty

- Difference Between Judicial And Non-Judicial Stamp Paper

- Stamp paper value