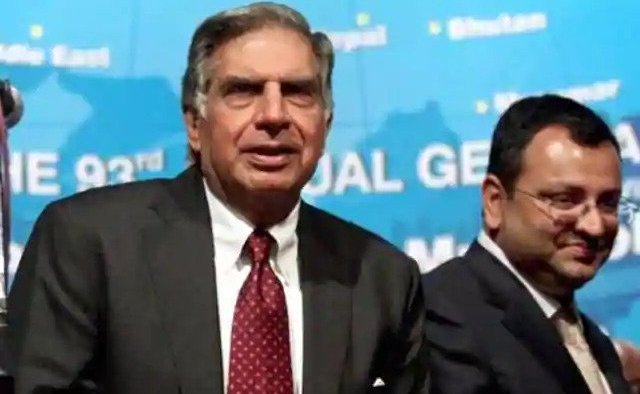

Cyrus Mistry and Ratan Tata are both promoters of the Tata group. They have a difference of opinion on how the Group is to be managed which has resulted in the present situation.

At the point when the Supreme Court starts hearing petitions recorded by the Tata Sons and the Mistry family from this month, it will choose not just the inheritance of Tata bunch patriarch, Ratan Tata, 82, and the privileges of minority investors yet, in addition, the wounded consciences of two top business families.

Timeline

2016

The controversy started way back in 2016 when on 24th October 2016 the Tata group removed Cyrus Mistry as the chairman and Ratan Tata was subsequently named the interim chairman. Cyrus Mistry on account of his removal accused the Trustees of shadow control. Ratan Tata had also accused him of not consulting the board regarding the purchase of Welspun Power to which Cyrus Mistry denied.

On account of his removal, the two investment firms Cyrus Investments Pvt Ltd and Sterling Investments Corp challenged his removal and oppression of minority shareholders and mismanagement by Tata Sons and moved to the NCLT (National Company Law Tribunal) where Cyrus Mistry was served legal notice by Tata Sons for an alleged breach of confidentiality.

On 19 December 2016, Cyrus Mistry resigned from all Tata group firms.

2017

In January 2017 a contempt plea was filed by Cyrus Mistry and his family in the NCLT wherein they contended that Cyrus Mistry’s removal from the board of Tata Sons was in violation of the court’s December 2016 order wherein not one of the concerned parties in the dispute was to initiate any movement in opposition to the alternative whilst the problem turned into under consideration and pending disposal of the company’s plea. Subsequently, N Chandrashekaran former TCS Chief Executive Officer and Managing Director was appointed as the Chairman by Tata sons.

On February 6, 2017, Cyrus Mistry was removed as the director on the board of Tata Sons.[1]

On 6 March 2017, the NCLT set aside the plea that was made by the two investment firms on the grounds of the maintainability issue and cited that they did not meet the criteria of ownership in the firm as 10 per cent was the necessary criteria of ownership in a company for the filing of a case of alleged oppression of minority shareholders under the Companies Act. While the Mistry family owned 18.4% stake in Tata Sons, its holdings were less than 3 per cent with the exception of preferential shares.

On 17 April 2017, the NCLT rejected the plea of the two investment firms seeking a waiver in the criteria of having at least 10 per cent ownership in a company for filing a case of alleged oppression of minority shareholders.

On 27 April 2017, the investment firms moved to the NCLAT (National Company Law Appellate Tribunal) challenging the NCLT order which rejected their filed petition over maintainability. Subsequently, they also challenged the waiver plea.

On 21 September 2017, the NCLAT allowed the pleas made by the two investment firms regarding the waiver plea, oppression and mismanagement of minority shareholders.

2018

On 9 July 2018, the NCLT dismissed the plea of the Mistry on the grounds that the company board lost confidence in him.

On 3rd August 2018, Cyrus Mistry approached the NCLAT in his personal liberty against the order passed by the NCLT and challenged his removal as the chairman of the company.

2019

On 29 August 2019, the NCLAT admitted the petition filed by Cyrus Mistry in his personal capacity and also decided to hear along with the main petitions filed by the two investment firms.[2]

In December 2019 Cyrus Mistry had been reinstated as chairman of the Tata Sons executive council and the chairman of three companies and it was also noted that the way the company’s shareholders had decided to turn it into a private company was illegal.

However, NCLAT had extended the four-month suspension of the implementation of its order to allow Tata Sons time to file a claim. The Tatas then went to Supreme Court where they filed an appeal against the NCLAT’s order to reinstate Mistry as chairman of Tata Sons and his reinstatement of three companies.

2020

January 2020– Cyrus Mistry stated that he did not want to return to the position of being the Tata Sons chairman and was ready to take any possible route in order to protect his family rights by pursuing the minority shareholder case by Tata groups holding company.

The statement passed by Cyrus Mistry came ahead of the Supreme court hearing on Tata Sons plea which challenged the December 2019 order which reinstated Mistry as the chairman of the company. The Supreme court on May 29 2020, began hearing on the case and has asked all the parties concerned to submit their replies within four weeks.

Question of law

Whether the court while dealing with NCLAT in order to reinstate his position is legal?

The point that has to be noted under this was that Cyrus Mistry’s official term was from 2012-2017 and the dispute arose in 2016 and according to the employment contracts in such cases compensation is given as relief and not reinstatement.

The general counsel of a leading multinational stated that the best the Supreme Court can do is offer relief to Cyrus Mistry as a minority director.

Whether converting the company from a public company to a private company before the hearing is legal?

On account of this question, the bench asked the Ministry of Corporate Affairs to submit details of the definition of private and public companies under the rules of the Companies Act. The bench has also sought clarification on the paid-up capital requirement for the same.

Whether the partnership between Cyrus Mistry and Tata Sons is a quasi partnership?

A quasi partnership is a company that possesses all of the characteristics of a partnership, including a relationship of mutual trust and confidence between the participants. It provides protection to minority shareholders where there is a personal relationship or mutual confidence. Long-term business partners and family-run companies are often defined as quasi-partnerships.[3]

- Whether NCLAT failed to explain how the actions of the Board constituted “prejudice” and “oppression” as per the legal tests under Sections 241 and 242 of the Companies Act 2013.?

- Cyrus Mistry was expelled by a greater part of the Board of Directors because of “loss of confidence” and whether that was a sufficient reason to do so? Whether NCLAT heading to reestablish Mistry sums to sabotaging standards of corporate-democracy rules?

Both the parties have filed their responses and the contention is as follows:-

- The Mistry family’s contention for corresponding board portrayal depended on its case that its stake in Tata Sons was a quasi-partnership. A few cases were referred to demonstrate this — individual letters composed by Ratan Tata to Pallonji Mistry and exchanges directed with Tata relatives were cited to demonstrate that the relationship had passed a straightforward monetary venture and had a personal character to it.

- The Mistry family said that since 1951, the family’s portrayal on the board developed from a group of organizations to Tata Sons. The Mistrys contended that Tata Sons’ shareholding design unmistakably shows that the holding organization is a two-bunch claimed substance as the Tata Trusts, Tata organizations and Tata relatives hold 81.5 percent and the rest are held by the SP Group, the main critical non-Tata value investor, making the arrangement a quasi-partnership.

- Tata Sons were consolidated in 1917, established by the late Jamsetji Tata and his family. Pallonji S Mistry and Sterling Investments purchased Tata Sons Partakes in 1965 — over 50 years after its consolidation and after a huge bit of the organization’s offers were supplied to beneficent trusts.

- Indeed, even this underlying shareholding was not a consequence of any terrific coalition or organization. No uncommon rights were connected to the Mistry family’s obtaining, and none were either requested or vowed to them.

- This acquisition of offers in 1965 was an exchange at business esteem between a willing purchaser and willing merchant, the contention ran, and there was no agreement, course of action or comprehension of any sort in which the Mistry family would sit down at the board or some other administration job.

- The Tata position is that the working gathering organizations are particularly legitimate elements, huge numbers of which are recorded with a huge base of open and institutional investors. The Tata Trusts are open altruistic trusts, not a private trust constrained by any relatives.

- On the contention that the Mistry family has been denied “exceptional rights,” the Tata Sons contention is that the main rights that are accessible to investors are those that gather in law or under the conditions of the Company’s Articles of Association as investors of Tata Sons. None of these rights was denied to Mistry or Mistry family they said.

- With respect to the certifiable democratic right, it doesn’t imply that the Trust-designated chiefs can pass any goal freely. Any Tata Sons board choice will require the help and greater part vote of the considerable number of chiefs. Article 121, at the most elevated, gives most of the Trust-selected chiefs an option to veto a choice; they can’t force their choice on the remainder of the Board. “It is likewise a matter of record that to date this ‘veto’ has not been practised even once to invalidate a choice of the Board,” the Tata bunch appeal said.

- It is important to note that NCLAT referred to Article 121 of Articles of Association and had noted that it was not open to the Respondents to state or allege that loss in Companies under the Tata Conglomerate was due to the mismanagement of Cyrus Mistry

- On Mistry’s charges that Tata took helpless business choices, Ratan Tata left it to the partners to choose and stated that

“At this phase of my life and profession, I might not want to either clarify or protect my exhibition as director of Tata Sons and of the other Tata organizations whose board I led during my residency. It is for the organizations and their partners to pass judgment,”

The judgement is yet to be passed but this is likely to be the final countdown of India’s biggest Corporate battle.

Reference Links

- https://www.indiatoday.in/business/story/chronology-events-tata-cyrus-mistry-fight-nclt-nclat-1629463-2019-12-18

- <https://www.indiatoday.in/business/story/chronology-events-tata-cyrus-mistry-fight-nclt-nclat-1629463-2019-12-18>

- https://nclat.nic.in/Useradmin/upload/9993183335e130f737d068.pdf.

- http://www.lawstreetindia.com/sites/default/files/stories/docs/Tata-Mistry%20NCLT%20Order-%20Key%20Excerpts.pdf

- https://www.hindustantimes.com/business-news/tata-sons-moves-supreme-court-against-nclat-order-reinstating-cyrus-mistry-as-executive-chairman/story-sV3B7gJ78x9oc0mydk4oRI.html

- <https://economictimes.indiatimes.com/news/company/corporate-trends/chronology-of-events-in-tata-mistry-fight-before-nclt-nclat/august-29-2019/slideshow/72870640.cms>. ↑

- <https://economictimes.indiatimes.com/news/company/corporate-trends/chronology-of-events-in-tata-mistry-fight-before-nclt-nclat/august-29-2019/slideshow/72870640.cms>. ↑

- .<https://www.clough-willis.co.uk/commercial-law-services/company-disputes/when-is-a-company-not-a-company>. ↑